open end loan secu

Enjoy our affordable interest rate of 1 monthly calculated on a reducing balance. Open in the SECU Mobile App Sign In.

Debt Consolidation With A Personal Loan Pros And Cons Credit Karma

Ad Looking for the Best Secured Loan.

. If you have an emergency need for cash and receive your paycheck via direct deposit into one of your Credit Union share or deposit accounts you may be eligible for a Salary Advance Loan. State Employees Credit Union in Raleigh North Carolina homepage. Ad Low Interest 2022 Top Lenders Comparison Reviews Top Brands Free Online Offer.

Open-end loans also often involve fees for late. Open-End Signature Personal Loans have variable rates and are available for LGFCU members residing in NC SC GA TN and VA. An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of.

Whether you use your loan to buy new furniture finance a home improvement or take the. Only Pay Loan Fees For What You Use. You can draw on this loan whenever you need it by simply calling the credit union.

SECU offers an overdraft transfer service whereby available funds are transferred from designated SECU share accounts money market share accounts other checking accounts. Members sign on access review bank highlights and articles check our loan rates and frequently visited links. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments.

Lines of credit both secured and unsecured are available for business needs such as. Contact 247 member services at 888-732-8562 or use the Ask SECU voice response system by calling 800-275-7328. Termination only occurs when either you recall your securities or the borrower returns them.

Ad A Business Loan Powered by American Express with Kabbage. A line of credit gives an open-ended access to a predetermined amount of credit. Connect With Top Lenders.

Open-end loans usually have higher interest rates and the interest compounds each month resulting in an increased balance. Applies only to new loans and not refinance of existing SECU loans. With a mortgage and most other loans you can choose between an open and a closed type of loan Here is what differentiates and characterizes the two types of loan.

Use Our Comparison Site Now. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Contact customer service at.

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back. Your money will be on its way immediately. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster. Refinancing available up to 150000 Competitive fixed rates with 5- 10- and 15-year repayment terms Competitive interest rates as low as 417 APR includes 025 discount for. Borrow for any worthwhile purpose or to consolidate existing debt into one low monthly payment.

Fixed rate of 500 APR 2 for terms up to 24 months Calculate Payment Fixed rate of 550 APR 2 for terms of 25-48 months Calculate Payment Variable rate 3 of 875 APR 2 4 for terms of. Open loans dont have any. There is a minimum loan amount of 250000 a maximum loan of 5000000 and a maximum 80 Loan-to-Value LTV.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. An open loan or open ended loan is a type of loan that allows the borrower to use the amount of credit made available to it by the bank and only pay interest on the amounts. Personal Loans SECU Credit Union Personal Loans OUR GATE REMAINS OPEN FOR YOU.

Depending on your borrowing need here are some options to consider on your loan or line of credit. An open-ended loan in securities lending is a loan where there is no agreed upon end date. Up to 100000 in 24 hrs.

Variable rate is subject to change quarterly and is based on. State Employees Credit Union NCSECU is based in Raleigh North Carolina and is the second largest credit union in the United States with over 21 million. Members must reapply for the revolving line of credit every 3.

State Employees Credit Union Mobile Payments

State Employees Credit Union Mobile Payments

State Employees Credit Union Secu Fast Mortgage

How To Borrow Money If You Can T Get A Loan

Secu Hiring Vp Mortgage Assistance Program Collections Support In Wake Forest North Carolina United States Linkedin

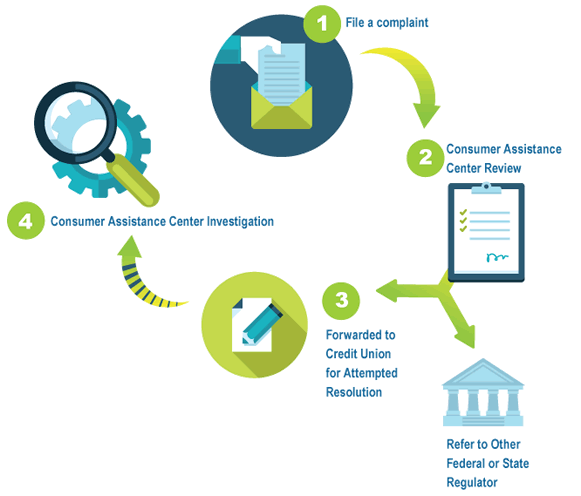

Complaint Process Mycreditunion Gov

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

An Expired Certificate Blocked Access To Microsoft Exchange Admin Portal Venafi

State Employees Credit Union Mobile Payments

Affordable Teacher Housing Dare County Ncimpact Initiative

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

State Employees Credit Union Mobile Payments

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

Pdf Similarity Bias In Credit Decisions For Entrepreneurs On The Brink Of Bankruptcy